Table of Contents

- 2025 Irmaa Income Limits - Lydie Laureen

- Estimated 2025 IRMAA Brackets: Navigating The Income-Related Monthly ...

- What IRMAA bracket estimate are you using for 2024? - Bogleheads.org

- 2025 Irmaa Brackets Based On 2025 Income 2025 - Clara Grants

- Irmaa Brackets 2025 - Karen Arnold

- Irmaa 2024 Income Brackets For Seniors - Marcy Valentina

- Irmaa 2025 Part D - Madge Ethelda

- Possible 2025 IRMAA Brackets

- 2025 Irmaa Income Limits - Lydie Laureen

- 2024 Irmaa Income Brackets - Janel Linette

What is IRMAA?

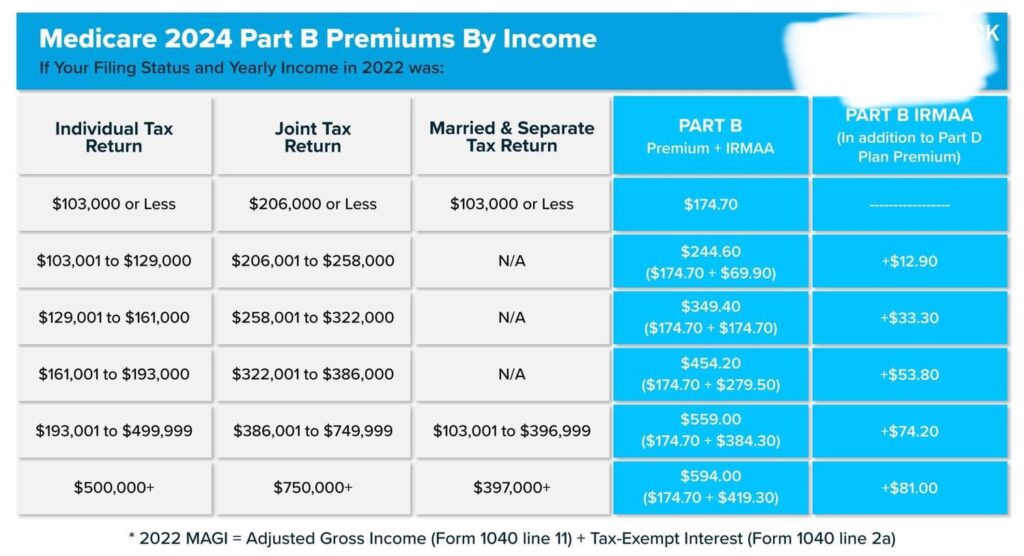

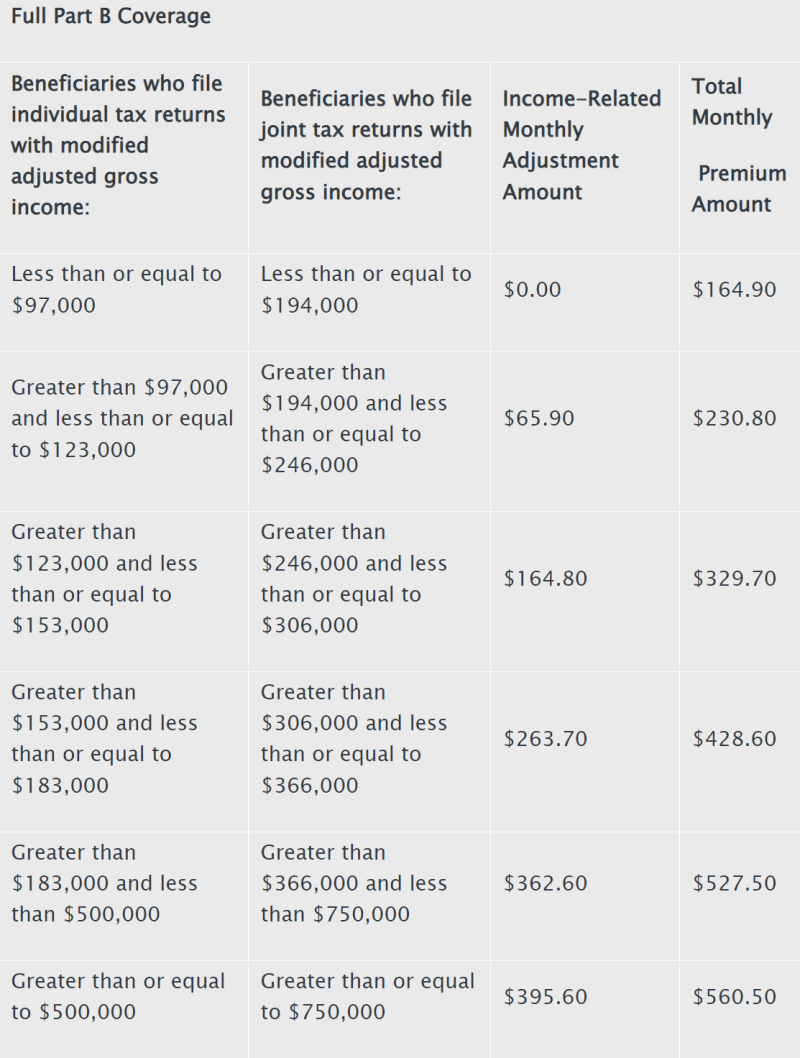

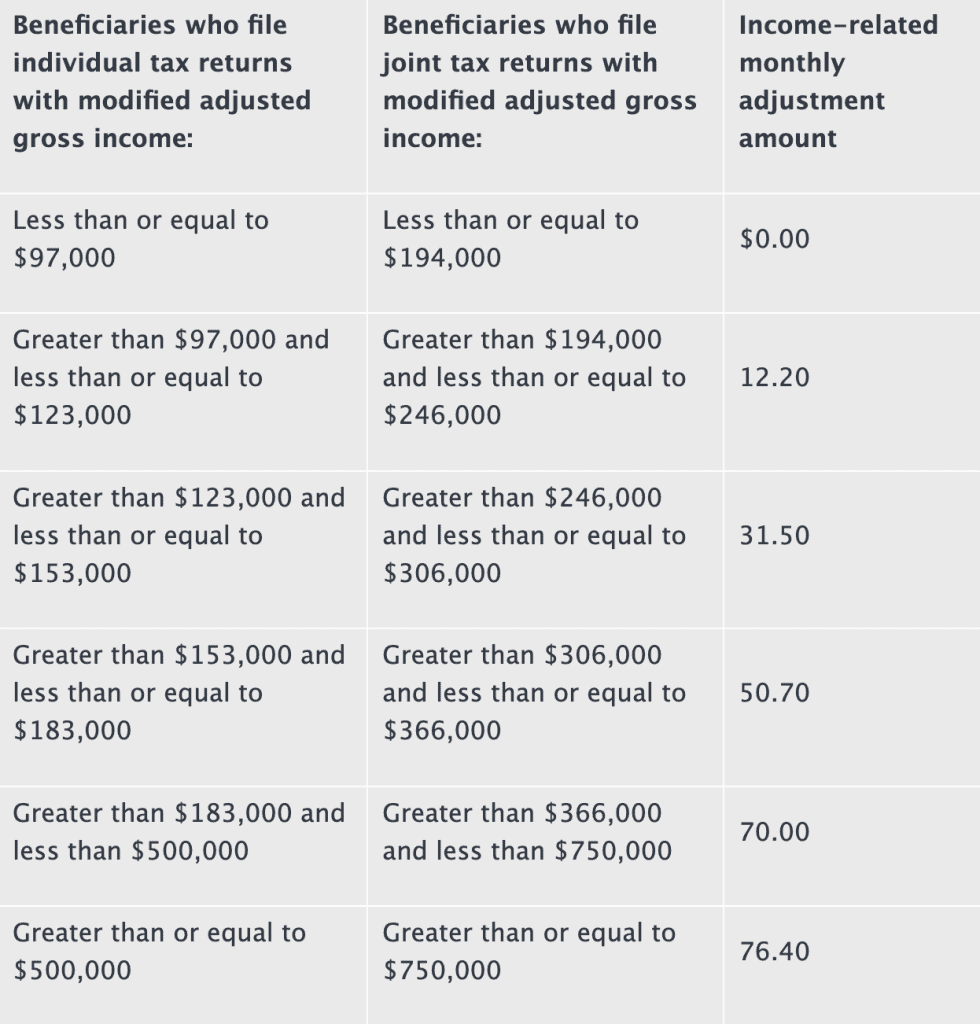

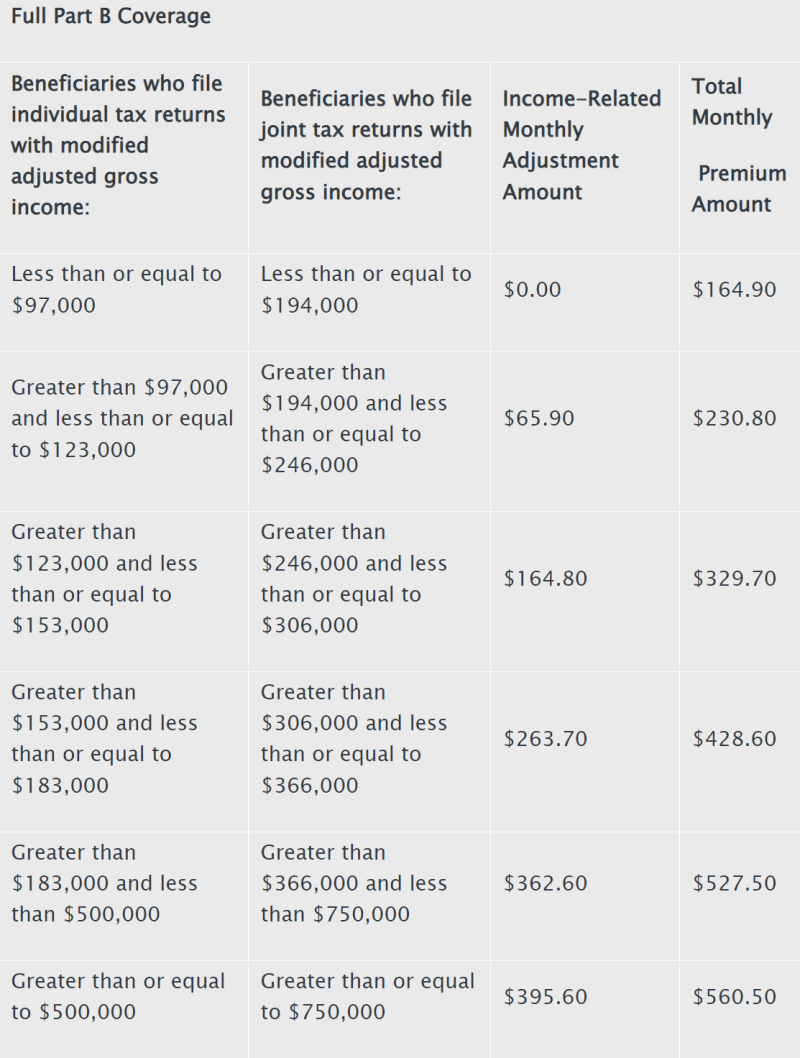

2024 IRMAA Income Brackets

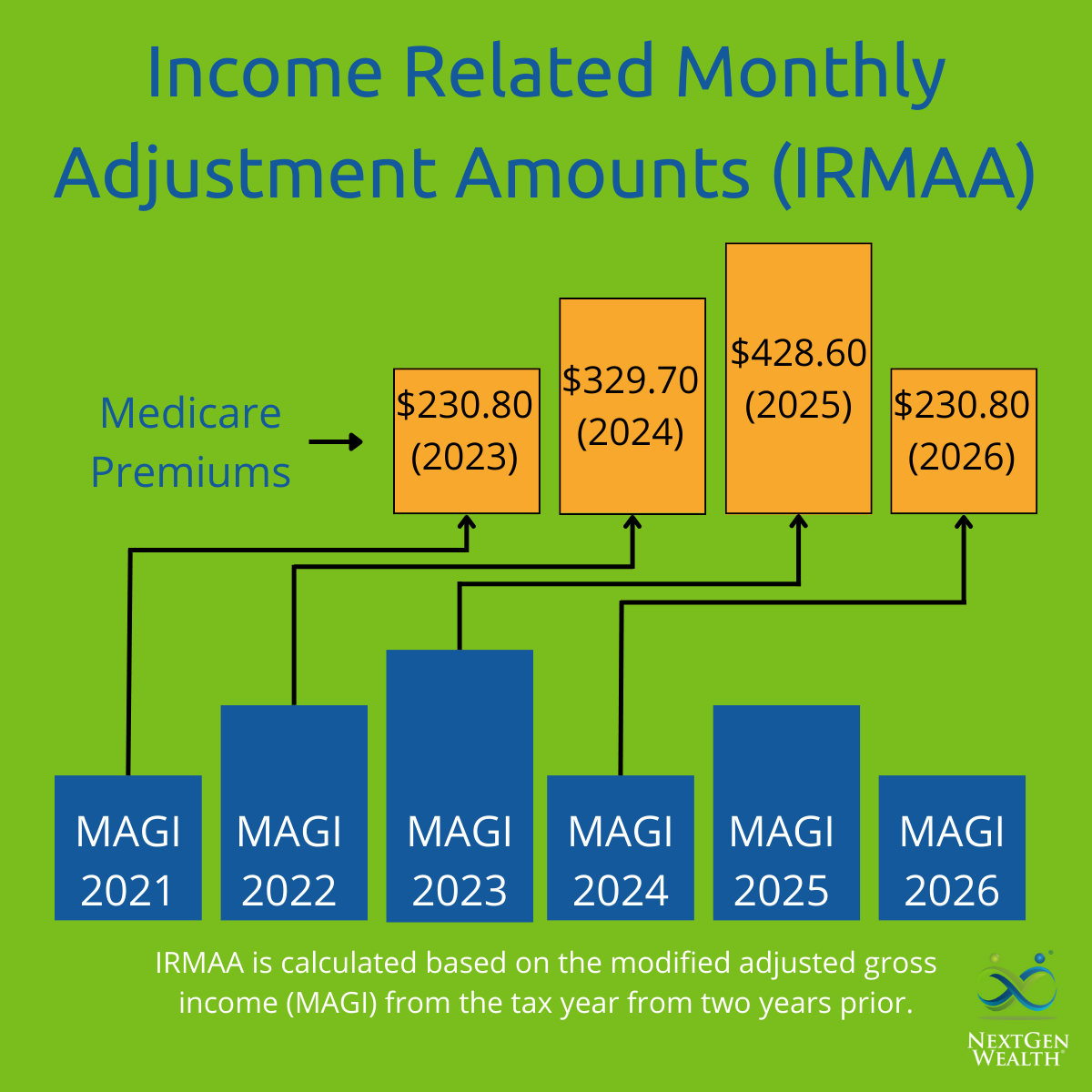

2025 IRMAA Income Brackets

The 2025 IRMAA income brackets are expected to be: Less than $100,000: No IRMAA surcharge applies $100,000 - $127,000: 40% surcharge $127,001 - $159,000: 60% surcharge $159,001 - $191,000: 80% surcharge $191,001 - $238,000: 100% surcharge More than $238,000: 150% surcharge For joint filers, the income brackets are: Less than $200,000: No IRMAA surcharge applies $200,000 - $254,000: 40% surcharge $254,001 - $318,000: 60% surcharge $318,001 - $382,000: 80% surcharge $382,001 - $476,000: 100% surcharge More than $476,000: 150% surcharge Understanding the IRMAA 2024 and 2025 income brackets is crucial for individuals who want to plan their Medicare expenses. By knowing how the IRMAA surcharge is calculated and what income brackets apply, you can make informed decisions about your Medicare coverage. If you have any questions or concerns about IRMAA or Medicare, it's always best to consult with a licensed insurance professional or a Medicare expert. Remember, it's essential to review your income and Medicare premiums annually to ensure you're not overpaying for your coverage. Stay informed, and take control of your Medicare expenses.Source: Healthline